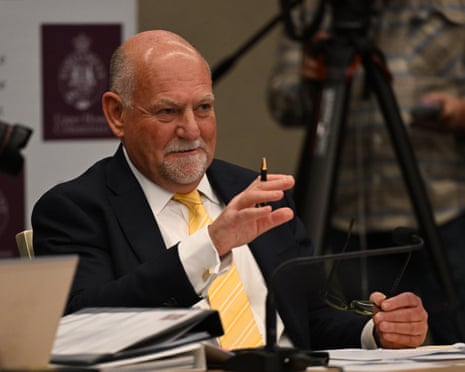

Minns’ team asked why premier focused on possibility of ‘terrorism’ in announcement

Jordyn Beazley

More on the inquiry into the New South Wales government’s handling of information about the caravan “fake” terrorism plot, where five staffers from the offices of the NSW premier are appearing.

The committee has continued to press the premier’s chief of staff, James Cullen, on why Minns told reporters shortly after news of the caravan broke that it could only be characterised as a terrorism event, while the deputy police commissioner said during the same press conference said there were alternative lines of inquiry and did not use the word terrorism.

Cullen, under questioning from independent MP Rod Roberts, told the committee:

The language potential mass casualty event was not a line dreamt up by the premier. It was in briefings from New South Wales police provided to the government, provided to the premier.

Cullen then reminded the inquiry that the deputy police commissioner, David Hudson, had made it clear there were alternative lines of inquiry.

Roberts responded to this by asking why then the premier did not tell the public there were alternatives to terrorism. He also pointed out that Hudson, nor the then police commissioner Karen Webb, ever used the word terrorism when describing the event.

Roberts, in his questioning, continued:

Now I watched that news, and I believed what the premier told me. I believed it right. He says there’s no alternative to terrorism at that stage. I have no reason to doubt it … The police end up sharing [there were alternative lines of inquiry] but the premier didn’t. So how does that provide calm? I’d in fact think that he would inflame fears that the community would have if the premier stood up there and said this is a mass potential mass casualty event and no other way of calling it other than terrorism.

Cullen responded:

I would just come back to, Mr Chair, that the premier’s comments on the 29th of January were based on the latest advice from police, and which was … there was a JCTT investigation looking at a potential mass casualty event, and there was lines of inquiry in relation to that.

Roberts then Cullen asked what the police briefed the premier about the alternative lines of inquiry.

Cullen said:

Look, I think I do need to be careful in terms of the progress of these particular briefings over a period of time, they do involve a delicate investigation regarding other agencies and sources.

Roberts continued to ask the same question multiple times. Cullen later responded:

Put it this way, there were … alternative lines of investigation that were clearly being explored, early on, and really didn’t – for want of a better term – get shaken out until the 21st of February.

Key events

Patrick Commins

Surgeon remains highest paid occupation in the country

Continuing on this report, while delayed by nearly two years, the annual taxation statistics provide an insight into who pays tax and how much they pay, alongside a range of other insights.

For example, the report revealed the country’s more than 4200 surgeons were once again in the highest paid occupation, with an average reportable income of $472,475.

They were followed by anaesthetists, with an average taxable income of $447,193, and financial dealers, who reported average earnings of $355,233 in 2022-23.

The well-known wealthiest suburbs in Sydney’s eastern suburbs had the highest average taxable incomes.

Those living in postcode 2027, which includes Darling Point, Edgecliff and Point Piper, earned on average just shy of $280,000 a year.

Or at least that’s what was reported as taxable.

There was also evidence in the ATO stats of how even very high earners are escaping paying any income tax.

There were 91 individuals who earned over $1m in 2022-23 and paid no income tax, according to analysis by The Australia Institute.

They claimed a total of $390m in deductions to reduce their income below the tax-free threshold of $18,200 a year to avoid paying the tax man.

These individuals claimed $62.8m in deductions for paying accountants and lawyers to manage their tax affairs, at an average of $690,815 each, according to the analysis.

Patrick Commins

Half of all landlords claimed rental losses against tax in 2022-23

Half of all landlords claimed rental losses against their tax in 2022-23, after a 20% jump on the number of negatively geared property investors from the previous financial year, according to the Australian Taxation Office.

The jump in the number of Australians taking advantage of negative gearing to reduce their taxable income comes amid a growing debate over how to reform the taxation system to make it fairer and more efficient.

Analysis by Treasury shows that in 2021-22, nearly 40% of tax breaks to landlords went to the top 10% of earners, including as a result of the $6.3bn in claimed rental losses.

A total of 2.26 million individuals reported owning at least one rental property, the ATO figures showed, while about 640,000 owned more than one – roughly equivalent to the previous year.

There were nearly 85,000 individuals with four more investment properties, against the more than 1.6 million landlords with one rental property.

But there was a jump in Australians reporting losses on their investment properties, from 950,000 to 1.1 million individuals. That took the share of landlords claiming rental losses from 42% of the total to 49%.

Police confirm protester injured during arrest in Sydney

Following up our earlier post on the Greens alleging a protester at SEC Plating in Belmore, in Sydney’s west, were assaulted by NSW police, the police confirmed a woman was injured during her arrest. Four others were also arrested.

Police said officers issued move on directions to about 60 protesters allegedly blocking pedestrian access to the business on Friday morning.

A 29-year-old woman who police will allege did not comply with that direction was arrested.

After a second move on direction was issued, a 26-year-old man and 35-year-old woman were arrested for allegedly failing to comply with that direction.

Police confirmed that during her arrest, the woman sustained facial injuries and was taken to Bankstown hospital for treatment.

Police said a 41-year-old man then allegedly used obscene language towards police, and was arrested after allegedly running from officers.

Police said a “scuffle ensued” when police attempted to arrest protesters who were allegedly not complying with the directions, with a police body worn camera allegedly taken by an unknown protester.

Police alleged the device was found to be in the possession of a 24-year-old man who was arrested.

The 29-year-old woman was charged with refuse/fail to comply with a direction. The 24-year-old man was charged with larceny and goods in personal custody suspected of being stolen. The 41-year-old man was charged with using offensive language near a public place or school. The 26-year-old man was charged with refuse/fail to comply with a direction and hindering or resisting a police officer.

They were granted conditional bail to appear before Bankstown local court on 15 July. Inquiries remain ongoing.

The protest was targeting SEC Plating due to claims the company provides parts for Israel’s F-35 jets. The company has denied involvement in “business servicing F-35 components”.

Australians and New Zealanders world’s biggest consumers of cocaine: UN

A UN office of drugs and crime report for the past year noted that while Australia and New Zealand remains the highest worldwide for use of cocaine, consumption of cocaine – based on wastewater analysis – is lower than other parts of the world, suggesting that most users of cocaine are occasional users.

The data showed that for 2022-2023, 4.9% of the Australian population said they had used cocaine, with 1.3% in New Zealand.

Ecstasy use also remains the highest worldwide in Australia and New Zealand.

Cannabis use is also significantly higher than the global average, with prevalence of use exceeding 12% in Australia and New Zealand.

The report can be found here.

Australian economy tipped to strengthen

The next few years should see economic growth in Australia, despite the uncertain global backdrop, but may stagnate without serious tax reforms.

While Australia’s economic growth hit speed bumps early in of 2025 from Cyclone Alfred, other severe weather events and a dip in government spending, Deloitte Access Economics is optimistic the pace of economic growth will accelerate over the coming quarters.

“Conditions are improving,” the economic services company said in a report released on Friday.

Real wages are grinding higher (even if it will be around 2030 before pre-pandemic purchasing power is restored), interest rates are declining, and inflation is no longer preying on consumers’ wallets or their psyche.

That suggests consumer spending will pick up, despite the jarring effects of Donald Trump’s second US presidency and other global concerns weighing on confidence, the report states.

Construction activity will also be a source of economic strength, with a significant lift in dwelling activity expected across 2026 as the industry works through a backlog of projects and reforms to regulations and zoning take effect.

The quarterly report forecast Australia’s gross domestic product would grow by 2.1% in 2025/26 and 2.4% the following year, up from the 1.4% GDP growth in the year to March 2025.

The forecast is roughly in line with estimates from the Reserve Bank, which predicted in May that Australia’s GDP would grow by 2.2% in 2025/26 and 2.2% the next year.

The Deloitte report forecasts the central bank will cut interest rates by a total of half a percentage point over the rest of 2025, and again in 2026.

It predicts 2025 will be the nadir for the Aussie dollar, buying just an average of 63.60 US cents, from 66 US cents in 2024.

But it forecasts the Aussie will buy an average of 64.70 US cents in 2026, 67.4 US cents in 2027 and 68.70 US cents in 2028.

– Australian Associated Press

Amanda Meade’s weekly round up of media news is here.

Rafqa Touma

Thank you for joining us on the blog today. Handing over now to Josh Taylor who will keep you posted this afternoon.

Benita Kolovos

Battin questioned on legal challenge to Pesutto loan

Liberal leader was also asked about a legal bid to stop the Victorian Liberal party from providing a $1.5m loan to its former leader, John Pesutto. The loan was given to Pesutto to help pay the $2.3m in legal costs he owes fellow MP Moira Deeming, after she won a defamation case against him.

Lawyers representing Colleen Harkin, a member of the party’s administrative wing, filed an urgent application in the supreme court yesterday, seeking to block the transfer of the funds to Pesutto. However, the application was made after the money had already been sent.

A supreme court judge criticised the “half baked” legal action, saying it wouldn’t “get off the runway” until all 19 members of the administrative committee had been officially served as defendants in proceedings.

One of those defendants is Battin. When asked if he had received legal notice yet, he said:

Anything that’s before the courts, I can’t comment on, but everything has on that case [Deeming v Pesutto] has been said. I’m moving on.

When pressed by Herald Sun reporter, Shannon Deery, who said Battin was the “second leader in a row now to be dragged to court by a party member”, he replied that it was a “hypothetical”.

Deery replied: “It’s not a hypothetical. Lawyers in court … told a supreme court judge … we’re going to serve the other members of admin. You are one of them. You will be served this week, and there’ll be a court hearing next week …

Battin: “As a former police officer, I was told I was going to be served many things, and never got it served. It is a hypothetical, and what’s been said about it so far has already been said.

Asked whether he wanted the party’s administrative committee to be “cleared out”, Battin said it was “totally a decision for the party”.

Benita Kolovos

Victorian opposition leader welcomes Bush’s appointment

Brad Battin says the new commissioner is stepping into one of the toughest jobs in the country:

This is a job that is going to be almost impossible to do if he doesn’t get the resources from the government. And the first thing he can call out is the fact that the Allan Labor government cut his budget in their first budget for him earlier this year.

The Victorian Liberal leader was asked whether he supported his federal leader, Sussan Ley’s call to improve female representation within the party’s ranks. While Ley left the door open to gender quotas, Battin’s comments suggest he is less inclined. He said:

I’ll be proactively out there over the next few months, looking for our candidates. And I know that we need to have a stronger women presence here in the Victorian Liberal party and I’m very proud of the fact that we’ve met with many people who are looking at putting their hands up … some of our target seats across Victoria.

And we know that if we can work with these people coming in, representing our community, who are strong, active in their community, that we will actually have a fantastic representation come to the election next year.

Pressed on if he specifically supported quotas, Battin said:

We haven’t gone through the process of quotas here in Victoria at all. But what I will say is I’m very proactive on it.

I’ve been speaking to some amazing people who want to put their hand up for preselection across Victoria and I look forward to waking up on the 29th of November 2026 with a fantastic team, which will have many women out in the safe seats, or the seats that we’ve been targeting for a long period of time … I’ll say openly, yes, we definitely need to increase the number of women here in the Victorian Liberal party.

Benita Kolovos

New Victoria police commissioner sworn in

The Victorian premier, Jacinta Allan, is holding a press conference with the state’s new chief commissioner of police, Mike Bush, who was sworn in an hour ago at a ceremony at the police academy in Glen Waverley. He was announced as Shane Patton’s replacement last month.

Allan says Bush comes to the role with significant experience, having led New Zealand police for six years and overseeing “some of the nation’s most difficult and challenging of times”, including the Christchurch terror attack and the White Island volcano eruption.

She says he also “transformed” NZ police, increased public trust and saw the crime rate go down. It’s hoped he will do the same in Victoria, where the latest crime statistics released last week showed a 15% increase in offending, driven in part by a surge in youth crime.

Bush told reporters “there’s too much crime, there’s too much youth crime”. He says he will seek to instil more trust in police, introduce more technology, information and intelligence and bring a crime prevention mindset to the role. Bush says:

Whenever you go into any scenario, any situation, it might be family home, it might be a burglary – whatever – where there’s a victim, we’ve got to start thinking, ‘I’m not just here to respond and identify who might be the [offender]’. That’s important, but you’ve got to start thinking about, how do we never come back here? How do we make sure this person is never victimised again? And that’s a mindset. So they’re not just thinking response and investigation, resolved. They’re thinking of preventing harm for this person again. The best thing that can happen for a victim is that they never become one in the first place.

Claims woman’s face seriously injured amid NSW Police arrests at pro-Palestine picket

A statement from the offices of Greens MP Sue Higginson and senator David Shoebridge has claimed NSW police “violently attacked and assaulted protesters” and that a woman sustained serious injuries to the face during multiple arrests at a picket in Belmore, Sydney.

A protest at electroplating supplier SEC Plating – against its reported involvement in the production of parts used by Israel’s F-35 jets – “descended into violence,” according to the statement. SEC Plating deny involvement in “business servicing F-35 components,” they told Guardian Australia.

Higginson shared footage of the alleged incident on social media on Friday afternoon.

The statement continues:

The [alleged] victim of the assault is undergoing medical tests this morning, and the extent of the injuries may require facial reconstruction surgery.

“The State of NSW, and Premier Chris Minns, cannot arrest their way through community who are engaging in legitimate political expression against genocide,” a Rising Tide Organiser Zack Schofield, who was among those arrested according to the statement, said.

NSW police have not yet responded to the Guardian’s request for comment. Legal Observers NSW said five people were arrested at the protest.

The solicitors representing the woman who was allegedly assaulted, Peter O’Brien Solicitors, were also contacted for comment.

Earlier this year an international campaign urged F-35 fighter jet producing nations to stop supplying Israel.

SEC Plating told Guardian Australia: “we have no involvement in providing plating services for various parts used in the F-35 Jet program”.

“We do not have any business servicing F-35 components,” they added. “We do have business servicing some Australian defence manufactures however F-35 components are not part of this.”

Patrick Commins

Treasurer’s roundtable invitees announced

Jim Chalmers has released an early guest list for his economic roundtable in August, featuring the usual suspects from business lobby groups and unions, alongside the heads of the Australian Council of Social Services and the Productivity Commission.

The eight invitees are below (plus two union alternates).

There will be many more seats at the table, which Chalmers says will be in the government’s cabinet room and can accommodate up to 25 people (with a diverse cast coming and going over the three days).

The treasurer says the roundtable will focus on coming up with ideas to boost the country’s flagging productivity, and to help deliver as broad as possible a consensus for reform.

So far, Chalmers has highlighted tax as a major area of inquiry.

The public consultation process leading up to the roundtable opens tonight.

More invitations will be issued “in tranches” to experts, stakeholders and other lobby groups, Chalmers said in a statement.

“We know there’s broad interest and engagement in the roundtable, including from the states and crossbench, and we will have more to say about their involvement,” he said.

Somebody like independent MP, Allegra Spender, would hope to get an invite based on her advocacy and work on tax reform ideas.

The shadow treasurer, Ted O’Brien, has already been offered and accepted an invitation.

Here are the initial invitees:

-

Danielle Wood, chair, Productivity Commission

-

Sally McManus, secretary, Australian Council of Trade Unions

-

Michele O’Neil, president, ACTU

-

Bran Black, chief executive officer, Business Council of Australia

-

Andrew McKellar, CEO, Australian Chamber of Commerce and Industry

-

Innes Willox, CEO, Australian Industry Group

-

Matthew Addison, chair, Council of Small Business Organisations of Australia

-

Cassandra Goldie, Australian Council of Social Service

Two ACTU assistant secretaries, Liam O’Brien and Joseph Mitchell, have also been invited as alternates for McManus and O’Neil.

Adeshola Ore

Judge instructs Erin Patterson jury on alleged incriminating conduct

The judge in Erin Patterson’s triple murder trial has told jurors “there are all sorts of reasons” why an innocent person may behave in a way that makes them appear guilty.

Justice Christopher Beale says jurors can only treat alleged incriminating conduct in the case as an implied admission of guilt if they find the “only reasonable explanation of that conduct” is that Patterson believes she committed the offences.

He says if the jury reaches this position, it still needs to determine whether the prosecution has proved her guilt of the charges beyond reasonable doubt.

“There are all sorts of reasons why a person might behave in a way that makes the person look guilty and yet not be guilty,” he says.

Even if you think the conduct makes the accused look guilty, that does not necessarily mean the accused is guilty.

Beale previously outlined Patterson’s alleged incriminating conduct, which the prosecution is relying on, including discharging herself from Leongtha hospital against medical advice, dumping the dehydrator in the days after the fateful lunch and lies in her formal police interview.

Regarding discharging herself from hospital against medical advice, Beale says there is evidence about two previous occasions where Patterson did this.

Regarding the dumping of the dehydrator, Beale tells jurors to consider whether Patterson might have panicked due to fear of being blamed for the deaths of the lunch guests.

Beale says he will conclude his instructions to the jury on Monday. We’ll bring you live updates then.

Judge says murdered Indigenous boy was a natural-born leader with great promise

A murdered Indigenous teenager who was chased into bushland and beaten to death was robbed of his life and promise in an act of brutality, a judge says.

Cassius Turvey, a Noongar Yamatji boy, died in hospital 10 days after he was deliberately struck to the head in Perth’s eastern suburbs on 13 October 2022.

Jack Steven James Brearley, 24, and Brodie Lee Palmer, 30, were convicted in May of murdering the 15-year-old after a 12-week trial.

Mitchell Colin Forth, 27, who was also on trial in the Western Australian supreme court for Cassius’s murder, was found guilty of manslaughter.

Chief Justice Peter Quinlan said the teenage victim showed great promise from a young age and was a natural-born leader with a sense of community that pointed to a bright future.

“Cassius Turvey was robbed of his life and of his promise … all because you killed him, Mr Brearley,” he said on Friday as he delivered his sentencing remarks.

You cut short Cassius Turvey’s life in an act of aggression, violence and brutality, which – regardless of the sentences I impose today – can never be made right.

You too are responsible for his death, Mr Palmer and Mr Forth, in different ways.

The judge also addressed claims the attack on Cassius was racially motivated, saying the killers used racial slurs to refer to him and other children he was with.

It was no surprise that an attack by a group of non-Indigenous adult men on a group of predominantly Aboriginal children using racial slurs that resulted in a boy’s death would have been interpreted as racially driven, Quinlan said.

That fear is real and it is legitimate.

Sentences are expected to be delivered later today.

– Australian Associated Press