Consumer group calls for congressional action as drivers fail to keep up with the cost of running cars

7 minutes ago

- Auto loan debt in America now sits at a shocking $1.66 trillion.

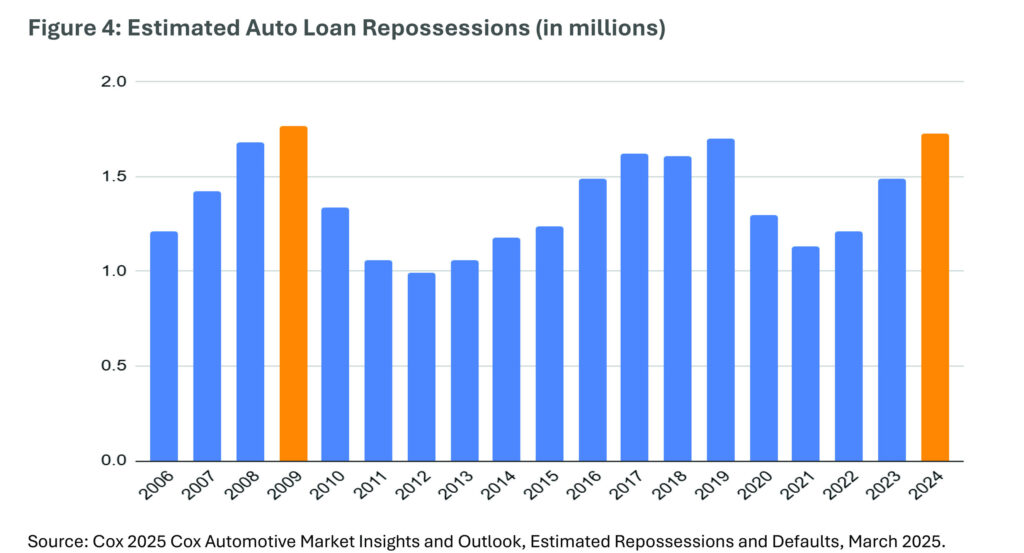

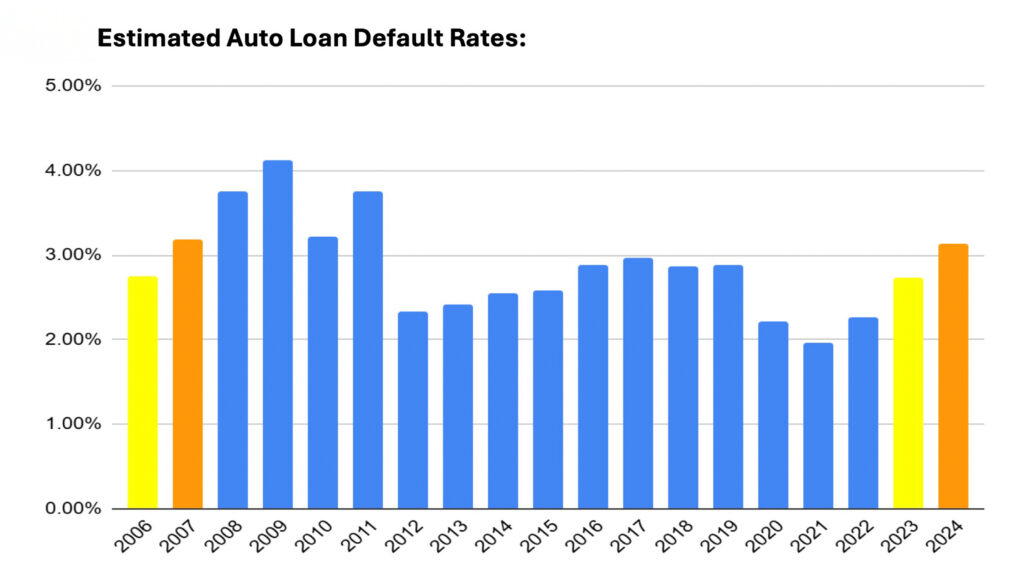

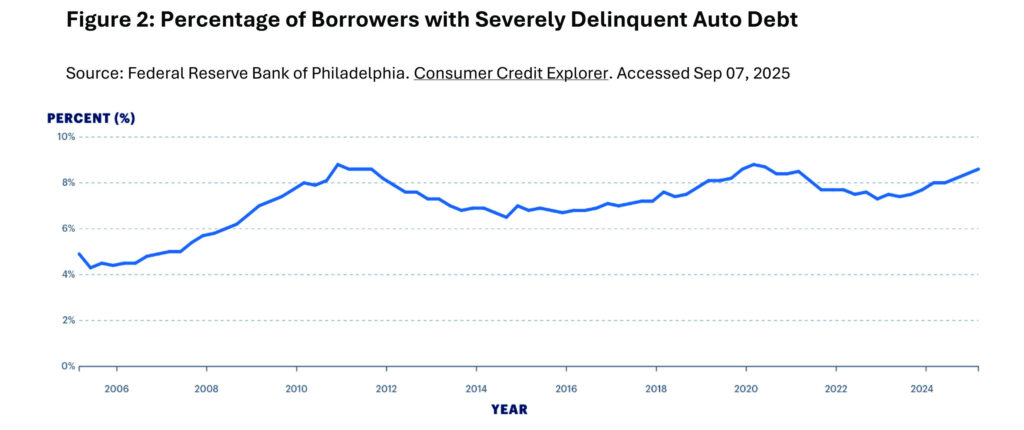

- Delinquencies, defaults, and repossessions are skyrocketing.

- Subprime delinquency is worse than in the 2008 financial crisis.

Many Americans love the feeling of driving a new car, but the price of that thrill is pushing household budgets to the edge. Auto loan delinquencies are spiraling, the nation now owes a staggering $1.66 trillion in auto loans, and some figures show scary similarities to the period right before the 2008 financial crash.

Also: One In Four Trade-Ins Are Now Underwater And It’s Getting Worse

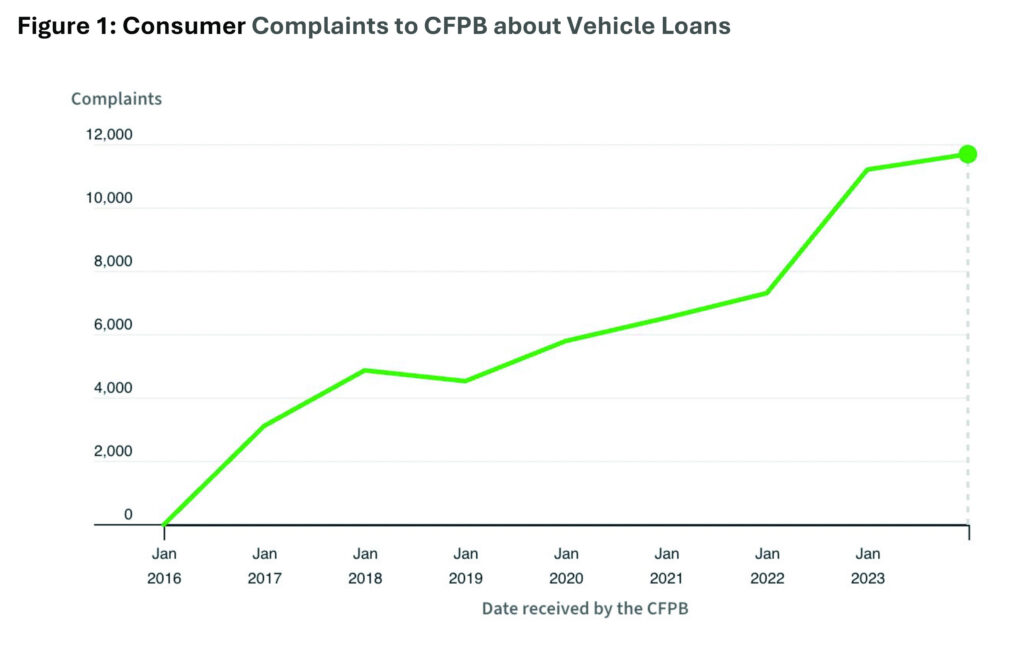

That’s according to a new report titled “Driven to Default: The Economy-Wide Risks of Rising Auto Loan Delinquencies” from the Consumer Federation of America (CFA). It describes auto finance in the US as being “at breaking point,” and criticizes Congress and the country’s federal watchdogs for stepping back, despite evidence showing they’re needed more than ever to protect buyers from unscrupulous dealers.

Crushing Monthly Bills

One of the reasons owners are struggling to keep their heads above water is the high cost of monthly car payments, caused in part by high interest rates. Figures show the typical monthly payment is $745 and 20 percent of buyers are saddled with monthly bills of at least $1,000. Things could get worse quickly because the $7,500 EV tax credit is due to disappear imminently.

And this time it’s not just subprime borrowers who are feeling the heat. Car buyers with above-average credit scores are twice as likely to fall behind on payments as they were before the pandemic. Younger buyers are hitting the payment skids in high numbers and the repossession rate across all age groups jumped by 43 percent between 2022 and 2024, according to Cox data.

A Wider Warning Sign

Moreover, the CFA warns that we should be concerned about more than a few cars getting repossessed because people haven’t kept up with payments. It says Americans have a tendency to prioritize their car bills over other household and living expenses, meaning the delinquency rates could be pointing to much more widespread and significant problems across the US economy.

“Now is the time for policymakers to take a hard look at the auto lending market to call out exploitative practices that raise prices and require our federal regulators to stop sleepwalking their way through this crisis while Americans suffer,” the organization suggests.

Personal Choices, Public Consequences

Still, there’s a question hanging over this: do drivers really need lawmakers to intervene, or is part of the solution simply about making different choices? To us, there’s an obvious way to avoid this mess, and it’s to be honest with yourself about your financial situation and buy an older car that’s been looked after. I broke my lease car habit five years ago and haven’t looked back since. But hey, whatever rocks your boat, right?